idaho estate tax return

To make sure your return is correctly processed include all forms and schedules in the following order. If the Tax Cuts and Jobs Act doesnt get renewed the exemption will fall back to its previous level of 549 million which it was in 2017.

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

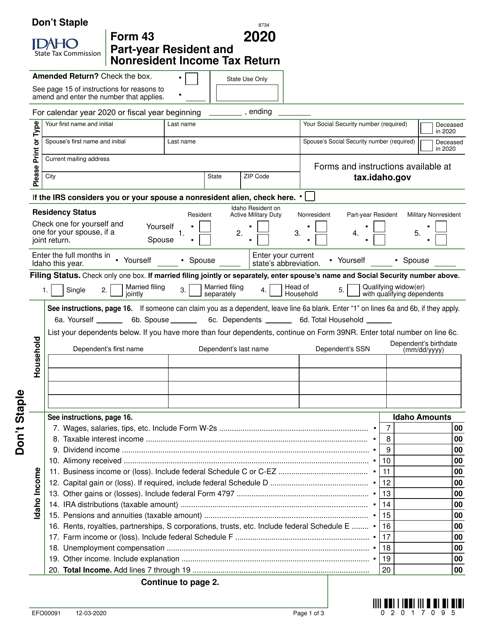

Since the 2018 tax year Idaho also has a nonrefundable child tax credit of 205 for each qualifying.

. Form 41 pages 1 and 2. Overriding the Governors veto requires a two-thirds majority vote in each chamber of the legislature. Prescription Drugs are exempt from the Idaho sales tax.

Tax return filing date. Nonprofit meeting requirements. PUC Public Utilities Commission.

Ballots postelection audits. 2020 Idaho Code and Statutes. Request for Transcript of Tax Return Form W-4.

The effective tax rate is the median annual property tax rate as a percentage of median home value. Idaho credits include the credit for income taxes paid to other states credits for charitable contributions and live organ donations and the grocery credit which is available to low-income taxpayers to offset Idahos sales tax on food. Letss assume the estate tax exemption is still 114 million when Dora dies.

If the Governor vetoes the bill however it will return to the legislature. PERSI Public Employee Retirement System of Idaho. We have several resources to help you protect your identity.

Idaho has 12 special sales tax jurisdictions with local sales taxes in addition to the state sales. Tax software takes care of the math and checks your return for errors missing information and potential savings. Form 41A if applicable.

Include a complete copy of your federal income tax return with your Idaho business income tax return. Phils 1158 million estate tax exemption was unused and Dora cannot claim the exemption without portability so Dora can only use her exemption of 1158 million when she passes away. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85.

The legislature can vote to override the Governors veto and pass the bill into law. Department of the Treasury Internal Revenue Service Center Kansas City MO 64999. City appropriation ordinances.

8939 historical form only Department of the. Our Income Tax Hub page lists all our income tax resources. Assembling your tax return.

The table below shows the effective rate for every county in Idaho as well as county-specific median real estate tax payments and median home values. LAW H0103. Dont hang on to your unfiled return too long however because you.

Our Identity Theft page lists what to do about your taxes if you think youve been targeted. Thus the estate tax rate is 40 and Doras estate is still worth 20 million. This is useful for comparing rates between counties and with other states.

Its also very important to read your tax return before you file it. Employers Quarterly Federal Tax Return. Note the current tax reform including the 117 million exclusion is only good through 2025.

Real estate licensure. Employees Withholding Certificate Form 941. Citizen or resident a domestic corporation or a domestic estate or trust must complete and file Form 926 to report certain transfers of property to a foreign corporation that are described.

Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. This estate tax form files the necessary taxes on the estate death taxes. Form 41ESR if applicable.

5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed Department of the Treasury Internal Revenue Service Stop 824G 7940 Kentucky Drive Florence KY 41042-2915. 2021 Idaho Code and Statutes. LAW H0349.

UCC Uniform Commercial Code. 2019 Idaho Code and. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

Comparing it to last years return can help jog your memory about deductions and other items.

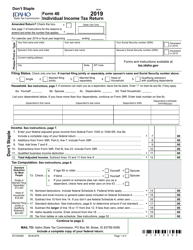

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Form 40 Download Fillable Pdf Or Fill Online Individual Income Tax Return 2019 Idaho Templateroller

Tax Form Templates 5 Free Examples Fill Customize Download

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Here S The Average Irs Tax Refund Amount By State Gobankingrates

Irs Tax Liability Upon Death If Married And Filing Separately

What Non U S Citizens Should Know About Filing Taxes Mybanktracker

Irs Fumble Means Extra Tax Reporting For Businesses In More Than 30 States

Will The Irs Extend The Tax Deadline In 2022 Marca

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

Idaho Estate Tax Everything You Need To Know Smartasset

How To Easily Amend Tax Return Before Irs Catches Your Mistakes Internal Revenue Code Simplified

Filing An Idaho State Tax Return Things To Know Credit Karma

How To File Taxes For Free In 2022 Money

Greystone Park Mansion 905 Loma Vista Drive Beverly Hills California Usa Mansions House Design Beverly Hills